Home Improvement News Fundamentals Explained

Wiki Article

Unknown Facts About Home Improvement News

Table of ContentsAll about Home Improvement NewsExcitement About Home Improvement NewsHome Improvement News for BeginnersA Biased View of Home Improvement News

So, by making your residence extra protected, you can actually make an earnings. The inside of your home can obtain dated if you do not make modifications and upgrade it from time to time. Interior decoration styles are constantly transforming and what was stylish five years back might look ludicrous now.You could also really feel bored after taking a look at the very same setup for many years, so some low-budget changes are always welcome to provide you a little bit of modification. You select to incorporate some traditional elements that will certainly proceed to appear current as well as trendy throughout time. Do not fret that these restorations will certainly be pricey.

Pro, Idea Takeaway: If you really feel that your home is too little, you can redesign your basement to increase the amount of room. You can use this as a spare area for your household or you can rent it out to produce extra income. You can maximize it by employing specialists who offer remodeling solutions.

Some Known Details About Home Improvement News

House restorations can boost the way your residence looks, however the benefits are a lot more than that. When you collaborate with a reliable restoration firm, they can aid you improve effectiveness, function, way of life, and value. https://pxhere.com/en/photographer-me/4056854. Hilma Building And Construction in Edmonton deals complete renovation solutions. Continue reading to find out the benefits of home remodellings.

Not just will it look obsolete, but locations of your home and crucial systems can begin to show wear. Routine residence repair and maintenance are needed to preserve your property worth. A residence remodelling can aid you preserve and also raise that value. Projects like exterior renovations, kitchen renovations, and bathroom remodels all have exceptional rois.

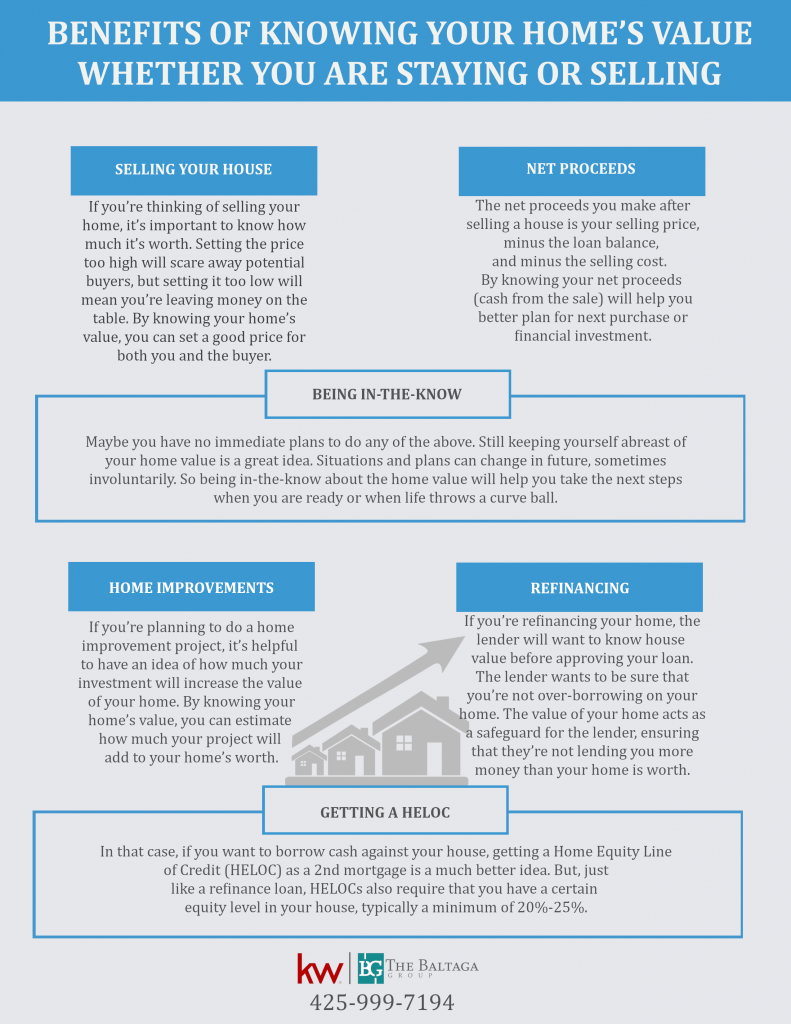

Residence equity finances are preferred among home owners aiming to money improvements at a lower rate of interest price than various other funding alternatives. The most common uses for residence equity. https://www.storeboard.com/homeimprovementnews financing are house improvement tasks and also financial obligation combination. Making use of a residence equity car loan to make house improvements comes with a few benefits that usages do not.

Examine This Report on Home Improvement News

That fixed rate of interest suggests your regular monthly settlement will be constant over the regard to your funding. In an increasing rate of interest atmosphere, it might be much easier to factor a fixed payment right into your budget plan. The other alternative when it concerns tapping your home's equity is a residence equity credit line, or HELOC.Both residence equity fundings and HELOCs utilize your home as security to safeguard the funding. If you can not afford your month-to-month repayments, you can shed your residence-- this is the most significant threat when borrowing with either kind of car loan.

Take into consideration not just what you desire now, however what will attract future purchasers because the tasks you select will certainly influence the resale worth of your home. Deal with check that an accounting professional to make certain your rate of interest is appropriately deducted from your taxes, as it can conserve you tens of thousands of bucks over the life of the car loan (home remodeling).

Rumored Buzz on Home Improvement News

House equity financings have reduced passion prices compared to various other types of lendings such as individual financings and charge card. Present residence equity rates are as high as 8. 00%, but individual financings are at 10. 81%, according to CNET's sibling website Bankrate. With a home equity loan, your rates of interest will certainly be fixed, so you don't need to stress over it going up in a increasing rates of interest environment, such as the one we remain in today.As mentioned above, it matters what type of restoration jobs you take on, as certain house enhancements provide a higher return on investment than others. For instance, a small cooking area remodel will recover 86% of its worth when you sell a house compared with 52% for a wood deck addition, according to 2023 data from Renovating magazine that assesses the price of redesigning projects.

While property worths have actually increased over the last two years, if house costs go down for any type of factor in your location, your financial investment in enhancements will not have really boosted your home's value. When you wind up owing a lot more on your mortgage than what your house is really worth, it's called adverse equity or being "underwater" on your mortgage.

A HELOC is commonly better when you desire a lot more adaptability with your funding. With a fixed-interest price you do not require to fret about your settlements going up or paying more in passion with time. Your regular monthly payment will certainly constantly coincide, no matter what's happening in the economy. Every one of the money from the funding is distributed to you upfront in one payment, so you have accessibility to every one of your funds instantly.

Report this wiki page